Impact of ESG on the Lubricant Industry: An Overview [Business]

As lubricant industry players face compelling challenges around sustainability issues, including product recyclability and greenhouse gas emission reduction, they are poised to focus on recycling and recovery of lubrication packaging into their ESG goals. Venture capitalists and other investors are prioritizing investment in sustainable businesses with environmental, social and governance concerns integral to corporate strategy. Bespoke solutions to reach sustainability and decarbonization goals could gain ground. ESG will remain pivotal in enhancing business ethics, creating sustainable growth with a resilient supply chain, retaining employees and attracting customers.

Forward-looking players are expected to foster their footprint on ESG standards that have become invaluable in gauging a company’s capability to make an informed decision. ESG factors are likely to play a vital role in containing organizational risks. It has emerged as the main cog in corporate policies and practices with investors and businesses gearing to address workplace safety, inclusion, access to affordable healthcare and environmental equity. The need for ESG disclosure has shaped how companies allocate funds in the global landscape, and the demand for accountability has underscored ESG disclosure to track sustainability performance. For instance, businesses in Europe are obliged to report the proportion of investment considered sustainable in line with EU regulations.

Environmental Perspective

Environmental, social and governance aspects are at the forefront as prominent players gear to overcome social, economic and environmental challenges. Leading players are poised to improve, respond and recover their resilience to the shifting ESG landscape. Investors are inclined to know how companies will respond to social, environmental and economic landscape and related opportunities and risks. A host of companies has come forward to publish sustainability reports as organizations across geographies, industries and company sizes allocate more resources toward enhancing ESG. According to the Governance & Accountability Institute, Inc. (G&A) 2021 Sustainability Reporting, 92% of S&P 500 Companies and 70% of Russell 1000 Companies published sustainability reports in 2020.

A significant part of ESG growth is mainly attributed to environmental factors and apt responses to climate change. Companies are likely to contribute disclosures in energy efficiency, biodiversity, environmental management, water efficiency and GHG emissions. For instance, Chevron Shipping could disclose vessels’ climate alignment scores leveraging the Sea Cargo Charter methodology from 2023. Further, the environmental impact of lubricants has prompted vital players to provide impetus to bio-based lubricants that can boost the sustainability quotient through high viscosity index, enhanced water quality and longer equipment life. Prominently, BP aims to contain scope 1 and scope 2 emissions globally by 30% by 2030. On the other hand, Shell has been providing carbon-neutral lubricants, including biodegradable multi-purpose grease and energy-efficient high viscosity index hydraulic oils to offset carbon footprint.

Social Perspective

On the social front, lubricant companies have emphasized data privacy, product quality, employee development, community support and development. Stakeholders have dubbed social license as corporate oxygen—impossible to survive without it. Some social practices, such as promoting equality and diversity in the workplace, providing training and well-being support and underpinning local and national charities will augur well for leading companies in the landscape.

According to Grand View Research Lubricant Industry ESG Thematic Report 2022, Idemitsu Kosan tops the chart in the social category with an impressive score of 70%. The tag is partly due to the institutionalization of human rights monitoring mechanisms across its supply chain operation. Besides, most companies are ISO 45001 standards certified and have rolled out robust healthcare plans and programs, H&S training and health insurance—promising factors bolstering employee retention rates. Meanwhile, Lukoil had the highest employee turnover rate (6.7%) in 2020 amidst comprehensive healthcare plans.

Prominent players have left no stone unturned to underscore their social and community investments. For instance, in 2020, Chevron contemplated injecting USD 15 million to underpin the Black community in the U.S. to address equity barriers. Besides, in 2021, the company poured USD 6.6 million into non-profits and community organizations in Kern, Fresno, and Monterey counties. The U.S.-based company is also said to have employed more than 700 full-time employees, along with 1,600 contract employees in those counties. Incumbent players are poised to get a grip with social factors as the building block of a sustainable world.

Is your business one of participants to the Global Lubricant Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Governance is envisaged as an indicator of how transparent, accountable and ethical a company is with stakeholders. It also highlights board structure, audit committee functioning, board independence and financial audit and control. An emphasis on governance could bode well with investors and customers and encourage sound risk management practices. Chevron is at the pole position in corporate governance, notes the ESG scoring model of Grand View Research. It has more than 90% independent directors—the highest in terms of a board comprising independent directors. The American multinational energy corporation established a Supplier Diversity Governance Board providing strategic direction and oversight of supplier diversity strategy across its U.S.-based units. With solid governance being the foundation to create value for stockholders, board members are expected to review operational, financial, market, political and other risks that are inherent in the business.

ESG is a valuable consideration—one that goes beyond philanthropic perception and is paramount to sustainable development. In essence, Royal Dutch Shell scored more than 80% in corporate governance—second to Chevron. The former has the highest percentage of female members on its board, taking a giant leap toward gender equality. The company is gearing to surpass or reach 40% of women in senior leadership by 2030. Governance will likely leverage companies to cash in on and manage various ESG risks and opportunities.

Well-established players and new entrants are slated to integrate ESG practices to foster brand reputation, propel sustainability and minimize costs. Companies are likely to focus on generating more environmentally friendly and efficient lubricants. For instance, in March 2021, Castrol rolled out the PATH360 strategy sustainability strategy with 2030 aims and focus areas, including reducing carbon, saving waste and enhancing lives. Stakeholders are bullish on the prospect of lubricants against the backdrop of heightened product demand and emphasis on ESG frameworks. The global lubricant market size garnered USD 125.81 billion in 2020 and could witness a 3.7% CAGR from 2021 to 2028.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

2023 Cold Storage Industry ESG - Thematic Report [Business]

Concerted efforts to enhance food- safety and -waste have encouraged cold storage industry companies to foster environmental, social and governance (ESG) performance. Sustainable development has come into the spotlight to foster eco-friendly refrigeration technology and utilize energy-efficient materials. Food & beverage companies have sought cold storage amidst an increased emphasis on ESG pillars. Cold storage is invaluable in preventing disruptions in food availability and emission-intensive losses of food. Food waste is one of the significant sources of GHG emissions, triggering food insecurity and burdening waste management systems. Increasing access to fresh food and reducing food insecurity can boost social equality.

Advancements in cold storage have provided potential opportunities for industry leaders to expand their ESG penetration. Stakeholders, including hotels, bakeries, stores, restaurants and other businesses, have invested in managing the temperature of perishable goods. Industry leaders have exhibited an interest in social opportunity, health & safety, diversity, product liability, business ethics, transparency and environmental opportunities.

Key Companies in this theme

• Americold Logistics, LLC

• Burris Logistics

• Barloworld Limited

• Cloverleaf Cold Storage

• Henningsen Cold Storage

Environmental Perspective

With carbon emissions becoming pronounced across business verticals, state-of-the-art refrigeration control systems have gained ground. Notably, energy consumption has become a major concern at refrigerated warehouses. Efficient cooling equipment and a temperature-controlled supply chain have received an impetus to minimize food loss and GHG emissions. The University of Edinburgh’s Department for Social Responsibility and Sustainability has undertaken cold storage sustainability project to minimize the energy consumption linked with cold storage facilities in Life Science Labs. In 2020, Americold poured over USD 8.4 million to complete 55 sustainability projects. The company installed four variable frequency drive (VFD) controls in four cold storage sites during the same period, saving around 1.5 kWh annually. It is contemplating installing 100% energy-efficient lighting across the global portfolio by 2030.

Social Perspective

Global push to minimize the environmental footprint of the cold storage industry has subsequently put the spotlight on the social pillar, including workplace safety, diversity & inclusion and investments in training & education, among others. Barloworld Limited is gearing up for a 50% female representation in leadership roles by 2025. The company has emphasized policies, such as Group Human Rights Policy, Employee Wellness Strategy, Group Talent Management Framework and Policy, Barloworld Harassment Policy and Group Health and Safety Policy. Industry leaders have upped their efforts to adopt a proactive approach to bolster safety management. For instance, the Total Recordable Incident Rate (TRIR) at Americold was 2.29 in 2020. Besides, the company launched inclusive hiring training for HR, talent acquisition and hiring managers in 2022. Stakeholders are poised to further their strategies for maintaining the culture of diversity and safety.

Is your business one of participants to the Global Cold Storage Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Good governance has come on the horizon as a torchbearer of innovation, growth and smooth functioning of organizations. Leaders have underscored their policies on ethics, corporate opportunities, zero tolerance for corruption and transparency. Shareholders and other stakeholders have vouched for a sustainable company that recognizes the impact of activities on the environment, society and the economy. To illustrate, executive management at Barloworld embeds an ethical and responsible culture to safeguard the interest of its shareholders and group. The company has also invested in anti-bribery and corruption and due diligence policies. It is slated to include ESG in Executive Performance Management and Remuneration philosophy, policy and practices. The South Africa-based company has furthered its tax strategy with an increased emphasis on Group Tax Risk Management Policy and disclosure and assurance practices in line with global standards and frameworks.

Well-established players and startups have reinforced their strategies on long-term cost savings, managing waste, diversity and sound corporate behavior. In doing so, industry dynamics, such as mergers & acquisitions, partnerships, technological advancements and product offerings, could gain traction. For instance, in June 2022, Burris Logistics acquired R.W. Zant to bolster its footprint on West Coast. The latter deals in the redistribution of diary brands and proteins to retail and food service distributors. These trends suggest the global cold storage market could witness approximately 13.4% CAGR from 2021 to 2030.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Paints And Coatings Industry ESG - Thematic Report [Business]

Sustainable and innovative solutions, underpinned by ESG goals, have garnered immense traction in the paints and coatings industry. Substituting hazardous substances and minimizing energy demand have posed challenges to stakeholders. Needless to say, paints and coatings offer essential coatings for offshore wind power plants, add color to the spaces, boost durability and underpin the transportation and hygienic production of food. The substance has had a vital role in helping minimize the environmental footprint, largely due to its innate ability to boost recyclability and bolster the life cycle of several products.

Lately, key players have explored opportunities in waste management and efficient production processes. However, several companies in the paint industry have been accused of greenwashing—using sustainability as a marketing gimmick—to hide their environmental lapses. The UN chief has been vocal in pushing for zero tolerance for net-zero greenwashing. According to the competition regulator in the U.K. Competition and Markets Authority, 40% of green claims made online could be misleading.

The paints and coatings industry is one of the highly demanded markets; the products have high applicability across various ranging from automotive to infrastructure markets. EU’s corporate sustainability reporting directive (CSRD) will compel companies to disclose comprehensive data to enhance the assessment of their sustainability efforts. It is worth noting that the EU Council gave a nod to CSRD in November 2022, a buoyant step to curb divergent sustainability standards, propel the company’s accountability and ease the transition to a sustainable economy. In March 2022, the British Coatings Federation (BCF) rolled out the “Green Claims Guide to Decorative Paints” to tackle greenwash claims in decorative paints. BCF asserted that the use of the terms “VOC free” and “Zero VOC” are false claims and should be avoided in the paint industry.

The U.S. Federal Trade Commission initiated a set of Green Guides to help marketers ensure their claims are not deceptive. Prominently, Green Guides were first issued in the U.S. in the early 1990s. In December 2022, the FTC sought public comments—on the term “recyclable,” “recyclable content,” need for additional guidance and carbon offsets and climate change—on the likely updates to the Green Guides.

Leading companies that have propelled their ESG strategies are delineated below:

1. Sherwin-Williams Pits on Environmental Targets to Gain Ground

The environmental profile has garnered prominence as sustainability continues to steer the growth across business verticals. Companies are pushing to the limit and finding ESG as a pivotal portfolio to contain carbon emissions and reduce waste in their value chain. Sherwin-Williams laid down its 2030 environmental footprint targets—to minimize waste disposal intensity by 25%, curb absolute Scope 1 and 2 greenhouse gas emissions by 30%, boost operational energy efficiency by 20% and expedite electricity from renewable sources to 50% of total electricity usage. The company notes that failure to mitigate environmental impact and emissions or respond to shifting consumer behavior and preferences could have repercussions in the form of reduced demand for products and services.

2. AkzoNobel Propels Carbon Neutrality Commitment

Companies, such as AkzoNobel have recognized the significance of ESG and underpinned their sustainability quotient. The Netherlands-based company committed to becoming carbon neutral by 2050 and has used a holistic Sustainable Product Portfolio Assessment (SPPA) framework. The chemicals firm is on course to becoming a zero waste company by 2030—77% reduction in waste to landfill was witnessed in 2021 vis-à-vis the preceding year. It has also developed wood coatings to foster manufacturing efficiency and energy-saving powder coating to provide 30% more output.

Is your business one of participants to the Global Paints and Coatings Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

3. PPG Industries Banks on Diversity, Equity and Inclusion to Stay Ahead of the Curve

Paints and coatings manufacturers have exhibited an unwavering commitment to further a culture of diversity, equity and inclusion. Chemical companies are leaving to stone unturned to propel the leadership roles for women and under-represented ethnic or racial groups. Not to mention, leading players have furthered their investments in bullish initiatives to strengthen accountability and engagement. In essence, PPG mentioned in its 2021 ESG report that an infusion of USD 7.4 million was made to underscore racial equity with educational pathways for people of color and black communities. It also injected USD 13 million to foster education and community sustainability in communities globally, while it is also committed to pouring USD 20 million from 2020 through 2025 to boost educational opportunities and social justice in underrepresented communities.

4. Nippon Paint Holdings Emphasizes Occupational Health & Safety

Global watchdogs have pushed for increased health measures as chemicals manufacturing is prone to accidents and health hazards. Investments in workplace safety have become pronounced to undergird the social profile. In 2022, Nippon Paint embraced the Group-wide Global Code of Conduct that considered stakeholder and employee safety in its activities. Meanwhile, in FY 2020, the Japanese behemoth updated the risk assessment lists to identify and address serious risks, including explosions and fire that lead to operation suspension. It has also put the spotlight on safety training programs. The company offered an online ISO internal auditor training course to 113 participants, online follow-up training to 78 new employees and online entry training to 89 new employees.

5. BASF Navigates Opportunities in Corporate Governance

Transparent and effective corporate governance has become indispensable to supervising and managing organizations and enthusing the confidence of financial markets, investors, employees, customers and other stakeholders. BASF has a two-tier corporate governance system with an effective and transparent separation of company supervision and management between its Board of Executive Directors and the Supervisory Board. As of December 2021, the German multinational company had six members on the Board of Executive Directors. It has also taken a giant stride in compliance management, emphasizing audits and participation in training. In the 2021 report, BASF inferred that 77 internal audits were conducted on adherence to compliance standards and over 53,000 employees participated in compliance training.

6. RPM Prioritizes Diversity in Board Vacancies

Concerted efforts from RPM towards corporate governance and ethical practices & programs have placed the company in a solid position. It has deployed Route 168 training program and promoted transparency, balanced decision-making and diversity & inclusion across its operations. The Governance and Nominating Committee of RPM reports to the full Board on developing and recommending a set of corporate governance principles, overseeing ESG strategy, and identifying diverse candidates for Board members, among others. In January 2020, the company gave a green light to the Rooney Rule to fill Board vacancies, suggesting a mandate to include diversity in ethnicity and gender in the selection pool.

Companies of all sizes have envisaged ESG as tailwinds that can open avenues of growth and innovations. Leading players are gearing to underpin effective governance frameworks for fairness of the management, objectivity and transparency, and most importantly—to earn trust. A sustainable solution, waste management and a renewed focus on health & safety are some of the underlying factors that can take the ESG goals to a whole new level. The paints and coatings market size was pegged at USD 146.17 billion in 2019 and could witness a 4.3% CAGR between 2020 and 2027. Bullish ESG strategies will be pivotal to tapping into the global landscape.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Why Cyber Security Companies Need to Prioritize ESG Practices [Business]

An uptake in high-profile data breaches and the exponential rise in digitization have redefined the dynamics in the cybersecurity industry. Stakeholders have become cagey towards data management practices and cybersecurity vulnerabilities. Lately, companies have started reporting on environmental, social and governance (ESG) performance, largely spurred by public opinion, regulatory requirements and soaring demand from stakeholders. ESG-focused businesses and organizational practices are expected to gain ground to maintain and achieve cyber resilience. With sectors such as fintech companies, oil and gas, financial services, public utilities and retail under immense pressure from the board of directors, investors and other stakeholders to be more transparent, industry players are expected to bank on sustainability.

Incorporating factors beyond financial into assessments of company performance have become paramount amidst a surge in cyberattacks. For instance, in November 2022, Microsoft reportedly blamed a Russian GRU hacking group for cyberattacks on transportation and other logistics industries in Poland and Ukraine. Moreover, surging cybercrime costs, such as lost productivity, destruction and damage of data, intellectual property theft, post-attack disruption, fraud, embezzlement and stolen money, have compelled stakeholders to rethink their strategies. Cybersecurity Ventures states global cybercrime costs could touch USD 10.5 trillion annually by 2025. World Economic Forum’s Global Risks Perception Survey 2021-2022 listed environmental risks as the five most critical long-term threats.

Notably, stakeholders are likely to foster ESG reporting practices to bolster transparency as cyber resilience has become a force to reckon with to augment sustainable earnings. Potential stakeholders envisage a sustainability portfolio as the top agenda amidst issues, including climate change and anti-corruption. Industry players are slated to keep ESG goals at the forefront for an expedition of inclusion, fairness and equitable access to opportunities and ensuring a regenerative and sustainable future.

Key Companies in this theme

• Cisco Systems, Inc.

• Palo Alto Networks

• McAfee, Inc

• Broadcom,

• Trend Micro Inc

Cisco Emphasizes Environmental Stewardship to Tap into the Growth Potentials

Cybersecurity firms have reinforced their position in the global landscape with an increased focus on the ESG pillars. Notably, environmental stewardship has come to the fore to steer the protection and responsible use of the natural environment sustainably. For instance, Cisco is guided by its corporate Environmental Policy and ISO 14001 Environmental Management System (EMS). The company had 30 sites with ISO 14001 certification in the fiscal year 2021. In April 2021, Cisco announced it would be infusing USD 100 million to address the climate crisis and help reverse the climate change impact over ten years.

Furthermore, in the fiscal year 2022, it rolled out the Environmental Sustainability Specialization (ESS) to help channel partners promote product takeback, educate customers, boost their sustainability practices and move to circular business models. During the same period, the company came up with Cisco Green Pay to assist customers in building an environmentally friendly technology strategy to attain ESG goals. It has also furthered its investments in state-of-the-art technology to help users leverage grid decarbonization, monitor grid reliability, water and transportation systems and bolster the workplace. The U.S.-based company remained instrumental in leveraging employees to work from home with AnyConnect VPN, WebEx by Cisco and TelePresence.

Social Performance Gains Ground with McAfee Propelling ESG Profile

With cybercrime-as-a-service becoming pervasive, cybersecurity has become an invaluable part of the ESG for companies, regulators, investors and consumers. The high number of incidents has propelled the need for optimized security operations and a strong social pillar. For instance, Fortinet is gearing to train 1 million people in cybersecurity by 2026. It cashed in on advanced technologies, such as machine learning (ML), artificial intelligence (AI) and deep learning to propel the design and growth of cybersecurity solutions and services.

In addition, pay parity has garnered headlines amidst growing women’s participation in the corporate world and surging role in the global economy. To illustrate, in April 2022, McAfee celebrated three years of maintaining pay parity and claimed to be the first cybersecurity company to attain the policy. Besides, the representation of women was pegged at around 30.9% in 2021, up from 27.6% in the preceding year. The company has also upped its focus on diversity as 16.3% of new hires in the U.S. were underrepresented professionals (Black, American Indian, Hispanic / Latinx, multiracial and Pacific Islande) in 2021.

Companies have fueled their efforts to set audacious goals to communicate the company’s development transparently, boost women’s participation and design long-term sustainable programs that address social impact. To illustrate, around 31% of external hires for VP and above positions in Palo Alto Networks identify themselves as women. Besides, 78% of leadership teams have diverse representation and the company aims for 100% diversity by 2025. The company also bolstered safety in a hybrid work environment. In July 2022, Palo Alto Networks underpinned its Global Security and Safety team by hiring a Senior Global Environmental Health & Safety Manager. It has also underscored its position in the human rights field with “industry best practices” to analyze risks for cases of human rights violations in the supply chain.

Broadcom Fosters Governance Portfolio

Well-established companies are gearing to propel their ESG performance with a bullish approach toward governance policies. Stakeholders, stockholders and employees are expected to focus on the corporate governance framework for accountability and transparency. Prominently, in February 2021, Broadcom adopted the name Nominating, Environmental, Social and Governance Committee (NESG Committee), doing away with the term “Nominating and Corporate Governance Committee.” The company found in its 2021 Employee Ethical Culture Survey that 96.1% of employees were acquainted with the efforts of the compliance and ethics function.

It also expedited compliance training as it noted that more than 99% of its employees completed the course in 2021. During this period, it rolled out the Global Compliance Ambassador program to solidify compliance culture. In essence, the U.S.-based company listed corporate governance, cybersecurity and data privacy, ethics and integrity and product quality in its 2021 ESG priorities.

Is your business one of participants of the global cyber security industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Key players are leaving to stone unturned to underscore social responsibilities and provide avenues of growth to stakeholders. In doing so, the Board of Directors at Fortinet established the Social Responsibility Committee to introduce the highest level of governance in CSR issues. The company uses corporate governance practices to ensure compliance with all laws and do business ethically. Besides, there has been a surge in independent directors across industry verticals as companies vie to enhance their sustainability portfolio. To illustrate, around 75% of board directors are independent at Palo Alto Networks, while approximately 50% of BoD are diverse with different race, gender, nationality or ethnicity. In the fiscal year 2022, the company established a Security Committee of the Board to boost oversight about security issues, such as cybersecurity.

The competitive landscape alludes to an increased focus on cybersecurity leaders emphasizing innovations and technological advancements. Forward-looking companies and governments are poised to foster their ESG practices to keep abreast with the trend. In October 2022, the Cybersecurity & Infrastructure Security Agency (CISA) joined forces with the National Institute of Standards and Technology and the interagency community to release cross-sector Cybersecurity Performance Goals (CPGs). Meanwhile, in 2021, Fortinet has a dedicated Human Rights Policy to propel ethical business and responsible product use.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

How the Kitchenware Industry is Addressing Environmental Sustainability [Business]

Stakeholders are leveraging innovation in pursuit of enhancing life at home as kitchenware industry players emphasize agility and resilience. Social and environmental sustainability have created value with companies envisaging investment in home appliances to broaden ESG commitments. A sustainable future could redefine ESG goals, including reducing emissions, enhancing energy efficiency, prioritizing diversity and doing away with single-use packaging. ESG management has become instrumental in ensuring efficient progress with an emphasis on quality improvement, ecological environment, employee welfare system, occupational health & safety, business ethics and protection of customers’ rights and interests.

Prominent players are well-positioned to assess and address risks, opportunities and impacts in the kitchenware landscape and navigate the robustly evolving space of ESG frameworks. Notably, the global push for sustainable development goals (SDGs) could propel the sustainability quotient to enhance business operations and benefit customers, communities, suppliers and employees. The adoption of ESG factors will provide a slew of upsides, including increased job satisfaction, reduced safety-related cases, and a productive workforce.

Key Companies in this theme

• Boffi

• Scavolini S.p.a

• Tupperware

• Viners

• Chasseur

• Kenwood Limited

• TTK Prestige Ltd.

• Miele

• Whirlpool Corp.

• Kitchenaid

Environmental Perspective

Climate strategies and roadmaps for greenhouse gas emission reduction have come to the horizon as companies seek to contribute to global efforts to propel sustainability. Carbon efficiency has received uptake with companies bolstering their strategies and measures. For instance, in June 2022, Dollarama established its first Scope 1 and Scope 2 emissions intensity reduction target. The company has set the 2030 target with strategies, including minimizing dependence on fossil fuels, enhancing the energy efficiency of stores and augmenting use of clean energy and renewable sources. An emphasis on the environment will not only have a positive influence on returns but also negate the risk to investments. Prominently, Whirlpool has placed science-based targets for greenhouse gas reductions and sustainability goals.

Kitchen companies are foraying into innovation and technology to address key issues and challenges. Whirlpool created a sustainable product playbook in 2021 with chapters on sustainable packaging and recycled plastic content. The company has exhibited an increased inclination for the reduction of GHG emissions and addressing plastic pollution—it alludes to using 8% recycled plastic in dishwashers. The American home appliance company set a compelling target to use an average 18% recycled plastic content by 2025 in the EMEA region. In 2021, while it showcased the technical feasibility to use recycled PP in home appliance applications, it also suggested that 28% of its manufacturing sites garnered higher Environmental Pillar scores. During the same period, 90% of sites received Zero Waste to Landfill (ZWtL) Gold or Platinum status and the multinational manufacturer attained GHG emissions scopes 1 & 2 Intensity and Water Intensity. Robust implementation of bullish initiatives and emphasis on renewables could act as a catalyst and offer sustainable upsides to kitchenware suppliers and manufacturers.

Social Perspective

Creating and maintaining a zero-tolerance policy towards racial marginalization and recognizing the values of an inclusive workplace have provided avenues of growth. A diverse workforce with an emphasis on female representation, black and underrepresented minorities and goodwill in local communities has remained a vital cog to foster the ESG profile. Tupperware injected funds into mental health facilities and leapfrogged towards attaining global certification for gender equity in practices, pay equity, representation, skill-based hiring and inclusiveness. In 2021, women accounted for 68% of all new hires and 58% of the global workforce in Tupperware. Moreover, the U.S.-based company launched a workplace engagement survey, bolstered its internal communications and standardized bonus programs. The product manufacturer held talent assessments of managers and rolled out an e-learning platform, providing over 16,000 courses. The company asserts around 60% of Associates viewed more than 360 hours of content from courses, learning paths and videos.

Companies have also furthered their investments in training & development and employee welfare schemes. A prudent ESG strategy would potentially focus on products that can be accessible for underprivileged groups, including pregnant women, the elderly and children. LG has introduced braille stickers to help the visually impaired to use the function buttons. Besides, the South Korea-based company has created a safe working environment to provide an independent safety culture, boost employee satisfaction and offer a sustainable workplace. In an effort to propel diversity, LG aims to augment the ratio of female employees in Korea to 20% by 2030. Additionally, the company has operated childcare and breastfeeding facilities across 10 business sites in Korea, indicating a bullish approach toward ESG performance.

Is your business one of participants to the Global Kitchenware Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Responsibilities for ESG-related opportunities and challenges reside with the Board of Directors. Well-established brands and emerging companies have come to the fore to create value through sound governance and the highest standards of legal & ethical conduct. Governance targets pertaining to the diversity of the Board of Directors strengthen the company profile in the global landscape. Some of the facets, such as internal audit, risk management, ethics & compliance have witnessed pronounced attention. In essence, the Board of Directors at Tupperware comprised 45% women as of December 2021. Meanwhile, Dollarama had over 30% female representation on its BoD in 2021. Besides, Tupperware formed a bullish roadmap for enterprise risk assessment in 2021 and hired a new Director of Compliance to underscore compliance department leadership. The company aims to use ESG metrics in employee performance and compensation goals by 2030.

In a bid to underpin shareholder value over the long term, industry players have prioritized a smooth corporate governance structure. Board of directors tend to focus on ESG issues, including employee safety, climate, cybersecurity, human capital management, financial, marketing and inclusion & diversity. In doing so, companies have also vouched for the independence of the BoD to bolster the ethos of the decision-making right and explore new avenues of growth engines to boost corporate growth. To illustrate, the ESG committee at LG Electronics comprised four independent directors to supervise risk response pertaining to ESG and explore sustainable and long-term growth.

The competitive landscape has witnessed a paradigm shift as organizations vie to achieve the company’s vision of customer satisfaction and underpin ESG frameworks. With companies emphasizing environmentally friendly and solution-oriented kitchen products, boosting ESG goals could nurture a sustainable future. The global kitchenware market is poised to register around 5% CAGR through 2025, largely due to the influx of funds into sustainable products and solutions.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Investing in Athletic Footwear Companies with Strong ESG Practices [Business]

ESG has emerged as the top theme among athletic footwear industry companies to bolster a healthier planet and boost governance. Footwear manufacturers have realized the upsides of aligning with environmentally friendly production methods. Venture capitalists, investors and other stakeholders are emphasizing shoe design, manufacturing and supply chain that conserve energy, reduce negative environmental impacts and are safe for consumers, communities and employees. Recycling of footwear, solid waste recycling, CO2 emission, social responsibility and use of renewable energies could be pronounced to propel ESG performance.

An uptick in ESG adoption and evolving business strategies have encouraged investors to use sustainability as an engine of growth. Investors recognize that companies with sustainable credentials could outperform their rivals and competitors. Companies are banking on recycled sources and carbon-negative foam complementing renewable energy and less material usage.

Key Companies in this theme

• Adidas AG

• ASICS Corporation

• Fila Inc.

• Under Armor, Inc.

• Lotto Sport Italia S.p.A

• New Balance Athletics, Inc.

• Vans, Inc.

• Nike, Inc.

• Puma SE

• Reebok International Ltd.

Environmental Perspective

Sneaker manufacturers are echoing the role played by the dominance of climate change concerns among shareholders and other stakeholders. Forward-looking companies have committed to a more sustainable future as they continue injecting funds into environmentally preferred materials (EPM) and durable design. Notably, New Balance is contemplating sourcing 50% recycled polyester and 100% preferred leather by 2025. It is worth mentioning that recycled polyester helps minimize dependence on fossil fuels, while preferred leather helps reduce environmental impact across the supply chain. It also aims to attain zero waste to landfill in its footwear factories by 2025. Adopting more sustainable options could gain ground as companies commit to ending plastic waste and promote sports shoes made from recycled materials.

Social Perspective

Footwear companies are grappling with rising e-commerce penetration, fast-changing consumer preferences and demand for sustainable product offerings. The need for safe labor practices, workforce diversity, customer engagement and safe working conditions has prompted stakeholders to foster their social profile. In 2021, Adidas adopted a new assessment system to boost a range of KPIs, including training participation and resolution of workers’ grievances. The Germany-based company has solidified its position in promoting fair labor practices. In 2020, the shoe manufacturer bolstered its engagement with Tier 2 suppliers to see that company practices are in line with fair labor practices. In 2021, the company added “equity” to its diversity and inclusion commitment, underpinning its DEI to foster an inclusive workplace.

Is your business one of participants to the Global Athletic Footwear Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Transparency, sound corporate governance and risk & opportunity assessment have become invaluable to remaining competitive and enhancing sustainable success. Risk and opportunity management has gained ground to achieve financial goals. For instance, Nike’s Corporate Responsibility, Sustainability & Governance Committee (CRS&G Committee) oversees risks and opportunities, including reviewing investments, policies, activities, and strategies; offering guidance; and monitoring the progress toward and development of its Purpose targets. Prominently, NIKE Global Risk Management has been at the forefront of helping Nike in control and governance processes and build & maintain effective risk management. Amidst receiving flak for lack of DEI advancements, it set a five-year road map in March 2021 to create a diverse and inclusive workforce. The sneaker maker is gearing up to achieve 45% representation of women in leadership positions by 2025.

Incumbent players are cashing in on the rising footfall of sneakers across emerging and advanced economies. The advancements in low-carbon emission materials, design and technologies have led to energy-saving developments. To illustrate, in September 2022, ASICS rolled out a low-carbon emission sneaker with a carbon footprint of 1.95kg of C02e for every pair produced. These trends indicate the global athletic footwear market could witness a 4.9% CAGR by 2030, with a valuation of USD 127.3 billion in 2021. The immensely competitive nature of the sports apparel industry alludes to bullish investments in ESG initiatives.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Why has ESG Gained Traction among Recycled Plastic Industry Companies? [Business]

The growing spotlight on the environmental, social and governance (ESG) framework has prompted the recycled plastic industry players to foster their sustainability portfolio. Stakeholders are positioning themselves to connect brands with environmentally friendly plastic. In essence, recycling companies are gearing up to minimize waste and seek innovative ways to combat carbon emissions. Amidst the global push to eradicate pollution, packaging has garnered huge headlines. UNEP notes that global plastic production is pegged at 400 million tons per year. Besides, merely 9% of this is recycled and 12% is incinerated. Accordingly, in March 2022, the U.N. member states endorsed a resolution to beat plastic pollution and create an international legally binding agreement by 2024. Sustainable and affordable options for recycled products have gained ground, furthering the need for ESG frameworks globally.

Public policy could be instrumental in overcoming plastic packaging pollution. The ubiquitous nature of plastic has put pressure on regulators and investors to find solutions for pollution across sectors, including retail, manufacturing, industrial, and electronics. According to Greenpeace, supermarkets in the U.K. emit 800,000 tons of plastic packaging per year, while the government is committed to ensuring all plastic packaging is reusable, recyclable or compostable by 2025. Meanwhile, in May 2022, legislators in New York proposed two bills to enhance plastic recycling rates. It would need producers to eliminate toxic chemicals from packaging, minimize packaging and pay for recycling and disposal costs.

Veolia Bolsters Environmental Profile to Navigate Growth Potentials

Concerted efforts from manufacturers and suppliers to combat pollution have led to the demand for recycled products and services. The shifting trend toward recycled products is expected to foster the environmental profile. Companies upgrading technologies to reduce environmental impacts could be the new normal. Veolia asserted in its Integrated Report 2021-2022 that around 476 thousand metric tons of plastic were recycled in its transformation plants in 2021. The company has acquired a host of end technologies to recycle plastic and equipment for biological, material and energy processing. It expects around 610,000 metric tons of recycled plastic to leave its processing plants by 2023.

With China and countries from Europe and North American Free Trade Agreement (NAFTA) witnessing a surge in plastic production, stakeholders are poised to boost their efforts to eliminate waste from the environment. Leading players are likely to use polyethylene (HDPE or LDPE)—in packaging or construction—and polypropylene (PP)—in household appliances, furniture, automotive and construction. In October 2022, Veolia rolled out PlastiLoop which will help customers source recycled plastics with a host of polymers. The France-based company has been offering high-performance ready-to-use recycled resins, including HDPE, PP, PET, LDPE and PS.

Is your business one of participants to the Global Recycled Plastic Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

PureCycle Emphasizes Social Performance

Well-established players are positioning themselves to connect brands with sustainable and high-quality products and complement social responsibilities. Recycling technology companies are prioritizing workplace safety, diversity and training & development, recruiting & hiring, discipline, compensation & benefits. To illustrate, PureCycle has a Diversity & Inclusion Policy in place to foster non-discrimination, equal employment opportunity and diversity and inclusion, among others. The company alluded to a low turnover as low as 7.5% in 2021. It has also put forth risk management systems and formed policies to help reduce possible accidents, such as team member and visitor safety protocols, a code of business conduct and ethics, guidelines for management systems and operational excellence policy. Moreover, the company is slated to establish a recruiting and employee engagement program to reinforce a resilient workforce.

Investors, manufacturers and other stakeholders have underscored the importance of workers’ safety. Prominently Shell inferred that over 100,000 employees and contractors completed compulsory training on the Life-Saving Rules that came into effect from January 2022. It is also committed to its Shell Supplier Principles and expects contractors and suppliers to offer a dedicated whistle-blowing mechanism where grievances pertaining to labor and human rights, Health, Safety, Security, Environment (HSSE) & Social Performance (SP) and business integrity are recorded anonymously.

Get more insights about how key industry participants like REMONDIS SE & Co. KG, Biffa, Waste Management, Inc., Stericycle, Republic Services, Inc., WM Intellectual Property Holdings, LLC, and Veolia are identifying, analyzing, and mitigating ESG risks and ensuring compliance

Dow Invests in Corporate Governance Structure

Stakeholders have depicted profound inclination to enhance governance, accountability and transparency. In doing so, industry players are likely to maintain a board with diverse backgrounds, design compensation programs and ensure a culture of integrity. According to Dow’s 2021 ESG report, 5 new members of its board have been women or U.S. ethnic minorities in the last 3 years. It has also set comprehensive ESG disclosures in line with GHG Protocol, GRI, TCFD, WEF and SASB. In its 2021 report, the company alluded to meeting the 2017 commitment to fully implement the TCFD recommendation.

All board committees—audit committee; compensation and leadership development committee; corporate governance committee and Environment, Health, Safety & Technology (EHS&T) Committee— comprise independent directors. The board and its committees underscored ESG transparency and accountability with the first integrated ESG report in 2021. Furthermore, the company noted in its second annual ESG report released in June 2022 that it took a giant stride with enhanced carbon emissions reporting and climate risk disclosures and greenhouse gas intensity metrics.

Corporate governance, with the focus on recycling technologies, has become the mainstay for board members and stakeholders to remain ahead of the curve. In the last two years, Dow has reportedly infused around USD 50 million into recycling infrastructure, impact funds and major technologies to transform waste into solutions. Moreover, in June 2022, it revealed a slew of partnerships in plastics recycling, including the collaboration with Mura Technology. It will help eliminate plastic pollution with the construction of advanced recycling facilities. Mura’s first plant using the technology could begin in 2023 in England.

At a time when environmental, social and governance frameworks could propel customer-centric, innovative and sustainable, stakeholders could inject funds into organic and inorganic strategies. For instance, in January 2022, SCG Chemicals announced a collaboration with Shell to introduce eco-friendly lubricant bottles. The packaging reportedly recycles household plastic waste complying with ESG and the UN Sustainable Development Goals. Grand View Research anticipates the global recycled plastic market to depict around 4.8% CAGR by 2030. Industry leaders are expected to underpin their efforts to minimize GHG emissions, prevent plastic waste and provide recycled plastic products.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

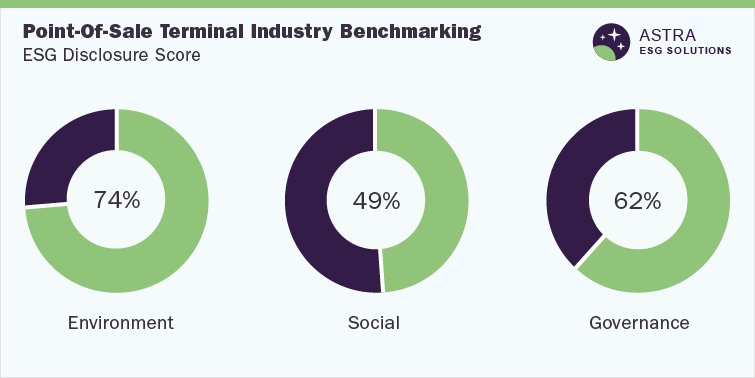

Point-Of-Sale Terminal Industry ESG: Thematic Report [Business]

The environmental, social and governance (ESG) landscape has gone mainstream in the point-of-sale (POS) terminal industry. Robust digital payment technologies have potentially removed or reduced paperwork and bureaucracy and minimized the need for cash. Predominantly, automated payment processes are fostering corporate work, while retailers have exhibited an increased inclination for POS terminals as sustainability factors garner traction among shareholders, investors, customers and other stakeholders. Payment companies have furthered their traction for ESG pillars to propel social credibility, enhance brand position and place social goals on top of the agenda.

The onslaught of the COVID-19 pandemic disrupted the normal circulation of coins and spurred the penetration of debit/credit card payments. The raw materials (chemicals made from petroleum) process emit GHG emissions, while the magnetic strips and smart card chips could augment the environmental costs. An uptick in cashless payments, along with the growth of mobile payments, has furthered the use of POS equipment. Besides, the generation of e-waste has expedited the need for robust governance and environmentally friendly strategies to provide a lasting impact on security, comfort and the environment.

Environmental Perspective

An unprecedented rise in waste from scrapped cards has prompted stakeholders to seek environmental principles to underscore a sustainability portfolio. Furthermore, carbon emissions from energy used to manufacture the cards have augmented the GHG. Industry leaders have vouched for digital wallets that may offset the environmental impact of debit and credit cards. According to a France-based merchant services technology company Ingenico, there are around 110 million terminals installed globally. The growth trajectory alludes to an increased focus on the environmental performance. The company has introduced eco-design of payment terminals to develop, design and provide products that are environmentally friendly. The service company has augmented R&D efforts to optimize terminals’ energy efficiency, minimize logistics’ carbon footprint, integrate sustainable procurement into the supply, eliminate toxic substances and reduce the raw material used.

Industry participants have sought carbon balancing to engage in proper e-waste management, foster an emission reduction strategy and offset the residual carbon footprint. For instance, in March 2022, Toshiba collected around 907 Kg of e-waste for recycling. It revised Response to Climate Change in Environmental Future Vision 2050 to attain carbon neutrality throughout the value chain. The company inferred in its Sustainability Report 2021 that it would inject funds into energy-saving equipment, bolster procurement of energy from renewable sources, bring renewable energy equipment to the fore and emphasize products and services that reduce GHG emissions.

Key Companies in this theme

• Cisco Systems, Inc.

• Panasonic Corporation

• Samsung Electronics Co., Ltd.

• Hewlett-Packard Inc.

Retailers, investors, manufacturers and other stakeholders have prioritized sustainability portfolio to unlock new opportunities to reach out to customers. According to the EU Eco-design directive, 90% of manufacturing costs and 80% of environmental pollution are due to the decisions taken at the production design. The use of recyclable and recycled raw materials could prove to be instrumental to add impetus to the environmental profile. For instance, Panasonic Corporation has minimized the waste generation by fostering the recycling rate of waste materials. Besides, HP exhibited the lowest emission and energy consumption rate in 2020 and aims for zero waste in operation by 2025.

Social Perspective

A robust ESG proposition could provide a win-win scenario as distributors, retailers and other stakeholders engage investors on their social performance. Social factors, including gender diversity, social trends, labor relations and inclusion, are expected to usher in innovations and growth through greater credibility. Bullish initiatives, including defining gender and racial representation and social-responsibility audits, will hold prominence, driving the business and benefiting shareholders and stakeholders. On the social pillar, Toshiba Corporation ranked supreme with approximately 90% score. In its Sustainability Report 2021, the Japanese conglomerate contemplated boosting the number of human rights awareness participants by 10% in the country from the preceding FY level. The multinational company has established a whistleblower system for employees—Toshiba Hotline—it received 129 cases in FY2020. Furthermore, in December 2020, the company rolled out the Chameleons Club with channels, such as LGBT+ Allies, to underscore and reinforce inclusion and deepen bonds among employees.

Is your business one of participants to the global POS Terminals industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Amidst companies gearing to encourage employees to feel fulfillment and pride in their work and harness technology, high turnover rates have sparked concerns among stakeholders. According to the Samsung Electronics Sustainability Report 2022, the overseas turnover rate was pegged at 15.7% in 2021, while it stood at 2.4% in Korea. However, it has robust labor and human rights framework with strong anti-discrimination and anti-harassment policies. The company provided specialized online training for 91% of staff members in jobs with increased human rights risks. Besides, it has around 32 labor unions and 40 Work Councils to enhance communication with employee representative bodies. In a bid to reflect the thoughts of youth in business activities, Samsung formed the Gen Z and Millennial Board to enable the younger generation to share their views on customer trends, products and trending topics on social sites.

Governance Perspective

Stakeholders are gearing to provide impetus to sustainability governance through transparent functioning, improved management efficiency, independence and expertise of the board, business ethics, and optimal internal controls. In the thematic report, Grand View Research’s ESG scoring model notes that HP was at the helm with respect to corporate governance. The HPE board comprised 12 directors with vast knowledge, skills and expertise, with eleven working as independent directors (as of FY 2021). Moreover, around 50% of board members were identified with one of the more diverse groups. HPE’s board committee of ESG includes an audit committee; human resources and compensation committee; a finance and investment committee; and nominating, governance, and social responsibility committee. Predominantly, the company has established an enterprise risk management (ERM) program overseen by the CFO and underpinned by HPE Executive Risk Council.

Ethical decision-making has gained ground to add fillip to business practices and encourage customers, employees, suppliers and stakeholders to voice concerns pertaining to business conduct. HPE asserts that ethics allegations and inquiries witnessed a 31% reduction in 2021 from 2019. Meanwhile, Cisco alludes to 1190 inquiries—53% of those related to conflict of interest disclosure, 28% questions and 19% allegations of misconduct—made to the Ethics office in 2021. The executive Leadership Team of Cisco recorded videos elucidating the significance of ethics and compliance to the company and shared real-life examples of violations observed within the organization during the same year.

Disclosure of corporate information can steward companies’ approach to ESG performance through transparency. In April 2022, Panasonic Group adopted an operating company system to boost Group management, secure management and improve corporate value. It has formed the Audit & Supervisory Board to foster the effectiveness of audit activities, assess and decide countermeasures and propel cooperation with the Internal Audit Department. Additionally, Panasonic has formed disclosure control procedures to adhere to laws and ordinances in Japan and overseas, to implement the accurate, fair and timely disclosure of information and comply with the rules of financial instruments exchanges. As stakeholders strive to bridge the gaps of the growing ecosystem and use advanced technology, the uptake in the point of sale applications could underpin the sustainability portfolio, leveraging them to count on the foundation of robust corporate governance and accountability.

Incumbent companies are responding to the unwavering popularity and significance of ESG goals to stay ahead of the curve. ESG programs on the global scale have become prevalent and frontrunner to bolster brand position in the long run. In August 2022, Toshiba Tec expressed contemplation in developing point of a sale software platform for U.S. retailers. The subsidiary of Toshiba is gearing to augment the number of employees by more than two-fold in the new Dallas hub by 2025. It is expected to have more than 30 software engineers in the U.S. hub by March-end 2023. The prevailing trends suggest exponential growth in digital payments could serve as a catalyst for the business strategies surrounding POS equipment. The global POS terminals market size stood at USD 85.16 billion in 2021 and could witness around 8.5% CAGR from 2022 through 2030. A notable shift towards a strong ESG proposition has become pronounced among financial stakeholders, investors, and companies that could exhibit potential growth opportunities emanating from ESG activities.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

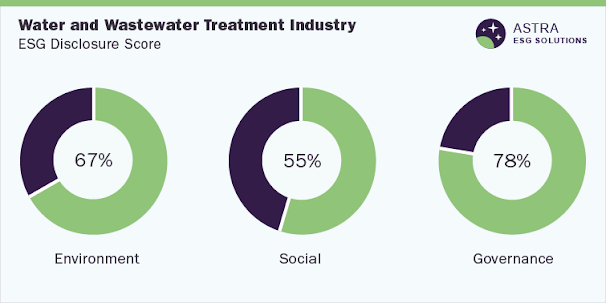

Boosting ESG Profile in Water and Wastewater Treatment Industry: Astra ESG Solutions [Business]

With the world observing unprecedented challenges and the influence of climate change, the water and wastewater treatment industry size could be pronounced on the back of bullish investment in a sustainable future. Developments of environmental, social and governance practices will help stockholders map impacts to their value chain, enable performance reporting and tracking and exhibit a corporate commitment to sustainable growth. Industry leaders are expected to shift their attention to the impact of water shortages, its soaring prices and surging regulations in their decision-making. Stakeholders are emphasizing 4R—reduce, reuse, recycle and reclaim—to streamline wastewater treatment and propel ESG analysis. Investors and consumers are poised to focus on the ESG profile and minimize operational risks amidst concerns about pollution, energy consumption, climate change and the rising usage of chemicals.

The World Resources Institute forecasts a 56% deficit of freshwater by 2030, compelling businesses to propel the management of water and wastewater treatment. The prevalence of water pollution and its impact on global health has furthered the need for ESG goals. Sustainable wastewater management has gained ground amidst an uptake in wastewater generation. For instance, in 2021, Merck Group produced around 13,3 million cubic meters of wastewater, while discharging approximately 9,5 million cubic meters of freshwater in surface waters. The company aims to minimize possibly harmful residues in wastewater by 2030. The surge in municipal wastewater and the prevalence of sewage have prompted stakeholders to emphasize environmental, social and governance pillars to keep up with the global trend.

Waste Management, Inc. is a waste management, comprehensive waste, and environmental services company operating in North America.

Environmental Perspective

Investors, suppliers and other stakeholders have prioritized the upsides of water treatment projects to minimize power consumption, reduce water use from the local supply, free up space and reduce off-spec discharge risk. Although the majority of Americans have access to safe drinking water, harmful contaminants, including copper, lead and arsenic, have been found in the tap water. Leading companies are expected to further their efforts to contain negative environmental impacts from chemical spills, wastewater discharges or water quality violations. For instance, California Water Service Group asserts its customers saved 47.8 million gallons of water in 2021 with increased saving efficiency measures. The public utility company assesses treatments on an industry-wide level, conducts audits and undertakes regular maintenance of wastewater treatment systems.

ESG considerations have become a management priority with wastewater reduction slated to foster the company’s environmental profile. Xylem, Inc. has set a bullish goal to recycle 100% of its wastewater by 2025. In May 2022, it introduced a smart wastewater treatment solution that can reduce operating costs and energy use by 25%. In April, the company announced an infusion of USD 20 million to foster innovative water and industrial technologies. Besides, Ecolab claims it helps customers manage 1 trillion gallons of water through the use of real-time data, management software tools, innovative technologies and treatment services. It also aims to conserve around 300 billion gallons of water annually by 2030. The company has also designed a wastewater treatment station in France to minimize water discharge to the city sewer network by approximately 80%, enabling the facility to reuse around 20 million gallons of water each year.

Is your business one of participants of the Global Water and Wastewater Treatment Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Social Perspective

Stakeholders have furthered their efforts on workforce development, diversity, equity, safety and health. Sustainable investors are likely to respond to the expanding scope of the social pillar as businesses and technological advances become interconnected. ESG-focused company Xylem remained at the helm with a roughly 80% score. The growth trajectory is partly attributed to robust human rights policies. Meanwhile, Ecolab has furthered its commitment to propel diversity and equity through its 2030 Impact Goals. The company contemplates augmenting its management-level gender diversity to 35% and management-level ethnic diversity to 25%. It has emphasized educating interview teams, recruiters and hiring managers on bias, diversity and inclusion. For instance, while 35% of all new management-level hires in the U.S. were people of color in 2021, globally around 38% of all new management-level hires were women.

Industry participants are striving to retain and attract talent—Veolia invested in an ambitious policy as the average number of hours of training per employee touched 21 in 2021. It aims to minimize the frequency of workplace accidents from 6.65 in 2021 to 5 by 2023. Besides, Ecolab hired 8,905 new employees in 2021, while the average turnover rate was pegged at 17.4%. Meanwhile, Xylem provided 12.61 hours of training per employee in 2021 and has introduced employee training programs, such as Employee Network Groups, Ignite and Watermark. It has strengthened workplace safety by introducing safety alerts and expanding digitally connected safety programs. According to Xylem Sustainability Report 2021, 49 of its facilities witnessed zero accidents in 2021, along with Querétaro, Mexico, São Paulo, Brazil, and Bogotá, Colombia facilities achieving five years without any recordable cases.

Governance Perspective

Leading players have pushed the bar with growing traction for strong corporate governance that bolsters accountability, underpins the long-term interest of shareholders and propels brand position. To illustrate, Xylem Board of Directors (end of 2021) comprised ten members, and all except CEO were independent. The soaring significance of ESG encouraged the organization to form the ESG Reporting Working Group to advise on, review and guide the evolution of its approach to ESG disclosure. It has also adopted 2025 Sustainability Goals to provide 35% of women with leadership roles by 2025.

Robust corporate governance is paramount to growing and sustaining businesses as companies seek to comply with core values and commitment to ethical standards and board diversity. For instance, 5 out of 12 California Water Service Group directors are women and the organization has 10 out of 12 independent director nominees. The utility company showed traction for a host of public policy initiatives in 2021, including the provision of up to USD 55 billion to address water infrastructure challenges.

According to Grand View Research’s ESG scoring model, Dupont de Nemours, Inc. was placed at the top in terms of corporate governance. The trajectory is mainly attributed to the governance standards and credibility among stakeholders—more than 90% of the board comprises independent directors. Furthermore, it has set the Sustainability Oversight Committee to review and approve sustainability policies and initiatives and oversee the Strategic Leadership Council’s work. In doing so, the company has embedded ethics and sustainability across global supply chains to propel a circular economy, climate change and diversity.

Well-established players and new entrants are expected to propel innovations and sustainability portfolios in treatment, water-reuse and -loss. Stakeholders are touted to expedite technological advancements, mergers & acquisitions, and commercial and social innovations. To illustrate, in August 2022, Veolia announced it inked a merger agreement pertaining to the merger of Vigie SA (previously known as Suez SA) into Veolia. While the actual merger took place in January 2022, the final merger was scheduled for October 2022.

With industry leaders emphasizing the reuse and recycling of wastewater, prevailing dynamics are likely to reshape the ESG landscape. An emphasis on cost reduction in wastewater treatment plants could help customers keep up with their operational budget. For instance, digitization is likely to help companies cash in on water, cost and energy efficiencies. Advanced solutions can provide real-time data to offer recommendations and suggestions to optimize aeration and water usage. Accordingly, the water and wastewater treatment market size could garner USD 41.8 billion by 2030. Bullish demand for wastewater treatment technologies and rigorous regulations will provide tailwinds to the global landscape.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.