The Importance of ESG Standards in the Biomass Power Industry [Energy]

“Carbon neutral, renewable and prevalent” has become synonymous with biomass power. Fossil fuel and industrial processes contribute 65% of greenhouse gas emissions, notes U.S. EPA. Biomass has emerged as an invaluable alternative to petroleum, coal and natural gas. Advanced wood-burning stoves, fireplace inserts and pellet stoves can reduce the amount of particulates from burning wood.

Industry leaders have furthered their focus on sustainability, workplace diversity, sound corporate behavior, transparency and ethics & compliance. Burgeoning demand for electricity generation, heating and transport fuels has furthered the demand for biomass power, a trend likely to shape the environmental, social and governance (ESG) performance and goals.

An uptick in biomass production has posed challenges and opportunities to provide products and technologies underpinning social and governance pillars in tandem with business activities. Leading players are vying for environmentally friendly solutions for a sustainable future, preferring biomass fuel to coal-based products. In January 2023, Valmet announced converting two coal-fired boilers to boost biomass combustion for Veolia Group's subsidiary in Hungary. The Oroszlány power plant is expected to produce over 600 GWh of renewable electricity. A sustainable response to energy challenges will potentially be observed in the near term.

Mitsubishi Heavy Industries Vies for Environmental Upsides

Global push to meet the sustainable profile has encouraged incumbent manufacturers to foster their decarbonization strategies with the reduction of water usage, waste generation and CO2 emissions. For instance, Mitsubishi Heavy Industries Group set an environmental target to decarbonize its business activity (scope 1 and 2) by 2040. In fiscal year 2023, the company expects to reduce water usage per unit by 7% and CO2 emissions per unit from plants and offices by 9%. The Japanese-based company has an interim target of minimizing scope 1 & 2 emissions by 50% by 2030 (compared to 2014 levels); and reducing scope 3 emissions by 50% by 2030 (compared to 2019 levels).

Is your business one of participants to the Biomass Power Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

Suez Fosters Diversity Culture and Workplace Safety

The need for a workplace environment that underpins social independence and reduces the gender pay gap help companies enhance their ESG rankings. In essence, boosting skills and employee engagement has become a go-to strategy to stay ahead of the curve. Suez is gearing up to leverage 5,000 people annually to gain from vocational integration programs. It also aims for zero serious accidents in occupational health & safety. Additionally, the company is bullish on eliminating the gender gap, with the target of 40% women in management positions by 2027. In 2021, the France-based utility company introduced WO&MEN network to promote gender equality and diversity and expedite shared experience.

Xcel Energy Accentuates Governance for Clean Energy Goals

Investors, suppliers, manufacturers, employees, customers and other stakeholders rate sound corporate governance highly. To illustrate, Xcel Energy alludes that all the members are independent, non-employee directors (except the Chairman and CEO). The company’s state public utilities commissions gave a green signal to clean energy plans for Colorado and the Upper Midwest, helping retire remaining coal operations and minimizing CO2 emissions 80% by 2030. Its Governance, Compensation and Nominating (GCN) Committee has ESG-related issues and risks responsibility. Investor’s Business Daily, an American newspaper and website, predominantly ranked Xcel Energy among the 100 best ESG companies in 2022.

The competitive landscape suggests stakeholders could inject funds into the circular economy, technological advancements, innovations, collaborations, mergers & acquisitions to further their ESG plans. The European Commission notes that biomass for energy contributes around 60% as the EU’s primary renewable energy source. Grand View Research reported the global biomass power market size at USD 121,340.76 million in 2021, which could depict a 6% CAGR between 2022 and 2030.

Browse more ESG Thematic Reports from the Energy Sector, published by Astra - ESG Solutions

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Solar Energy Generation Industry: Leaders Create a Sustainable Future—an ESG Perspective [Energy]

The Growth of the solar energy generation industry will depend on the proactive and relentless efforts of forward-looking companies to navigate the risks posed by climate change. Current and predicted issues expected to arise due to climate change have brought a paradigm shift in the ways businesses assess risk, and plan and deploy resources. Sustainability, security compliance, safety, business growth, and innovation have become instrumental to progress toward implementing best practices in environmental, social, and governance portfolios. The trend for green, sustainable, and safe pathways is likely to pay off and help make better economic sense in the long run. Prominently, solar energy generation has garnered popularity as one of the cheapest forms of electricity and will be a solid proposition to tap potential in energy generation.

In common parlance, solar energy plays an invaluable role in boosting sustainable development energy solutions. Solar energy generation applications are likely to play a vital role in fostering an environmentally friendly energy agenda. In essence, solar panels have gained ground to generate clean power and contain the cost of electricity. To illustrate, in June 2022, the U.S. Solar Buyer Consortium announced an infusion of USD 6 billion to bolster the domestic solar panel ecosystem with the supply of around 7 GW of solar modules per year from 2024. It is worth mentioning that the Solar Energy Industries Association asserts that the U.S. installed 23.6 gigawatts of solar capacity in 2021. The federal investment tax credit, along with renewable energy credits, advanced technologies, reduced installation costs, and financing arrangements, offers promising opportunities for stakeholders to emphasize solar power as an indispensable part of the ESG goals across the U.S.

Exelon Corporation Harnesses the Potential of ESG

With environmental issues spurring governance and social practices, investors are curious to know how businesses minimize their carbon footprint. Stakeholders are responding to these trends through ESG strategies. Several companies have come to the fore to inject funds into renewable energy to propel ESG sustainability goals. For instance, the Exelon Corporation reportedly avoided 78 million metric tons of GHG emissions with its zero-carbon nuclear generation. The company witnessed 161 million MWh zero-carbon generation, around two-fold more compared to the next largest producer. In July 2022, Exelon released the 2021 Corporate Sustainability Report and noted that it poured USD 6.6 billion in energy infrastructure in 2021 and is contemplating raking in USD 29 billion from 2022 through 2025. On the environmental front, the company claims to be working to minimize impacts on biodiversity and watersheds. It has also spurred sustainability through corporate governance—assessing accountability and risk.

Understand how key industry participants like Exelon Corp., E.On S.E., and Duke Energy Corp. are understanding and mitigating ESG risks and ensuring compliance

E.ON SE at Pole Position in ESG Disclosure; Emphasizes Green Electricity

Sustainability strategies and disclosures have come on the horizon amidst ESG being tasked with the goal of decarbonizing the global economy. When it comes to ESG disclosure, E.ON SE is at the helm, followed by Exelon Corporation and Equinor ASA. It is gearing to be climate-neutral by 2040 and its corporate governance is increasingly linked to its ESG management aspects. CDP, an international association of investors that independently assesses the transparency and detail of companies’ climate reporting, lauded E.ON as a Supplier Engagement Leader in 2021. In a bid to bolster the green-power community across Europe, E.ON Home, an energy management app, was introduced in the U.K. Similarly, it claims over 10 million customers received certified green electricity products in 2021.

Incumbent players have reinforced their efforts to underpin the decarbonisation of Europe. The company contemplates investing €1 billion (around USD 1 billion) annually through 2026 to significantly boost the infusion of funds into energy networks. It is geared to foster sustainable homes, work, and lifestyles with innovative solutions, including self-generated green electricity. It aims to install approximately 5,000 new charging points through 2026. The Germany-based company plans to pour €27 billion into energy transition through 2026. Furthermore, the company has also upped investments to provide green energy to take carbon neutrality and sustainability to the next level. For instance, in April 2022, E.ON inked a deal with Solar Market to create Green Cloud to offer green energy to corporate customers across Hungary.

The competitive landscape alludes to an increased focus on ESG framework and sustainable policies from forward-looking companies, such as E.ON SE, Adani Green Energy Limited, Equinor ASA, Nextera Energy, Inc., Exelon Corporation, Duke Energy Corporation, Solaria Energía y Medio Ambiente and ReNew Wind Energy (Jath) Limited. Besides, organic and inorganic growth strategies have become pronounced, underscoring solar energy generation market share. To illustrate, in November 2022, Equinor announced the acquisition of BeGreen, a Danish solar developer, to propel the solar PV portfolio. Meanwhile, in April 2022, the Norway energy giant forayed into the Australian market through investments in RayGen to provide impetus to solar energy. In November 2022, Equinor expressed contemplation to augment investment in renewables by two-fold and that renewable energy will account for approximately 20% of the company’s investments in 2022. Amidst the trilemma of the Russia-Ukraine war, energy security, and affordability, emphasis on renewable energy sources could be a game-changer with considerable environmental upsides in solar energy generation.

Is your business one of participants to the Global Solar Energy Generation Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Solar Energy Generation Industry ESG Thematic Report, 2022 [Energy]

Sustainability Assessment, Policies & Regulations, ESG Issues, Infrastructure Developments, Company Profiles, Benchmarking, SWOT, Company ESG Disclosure Scores

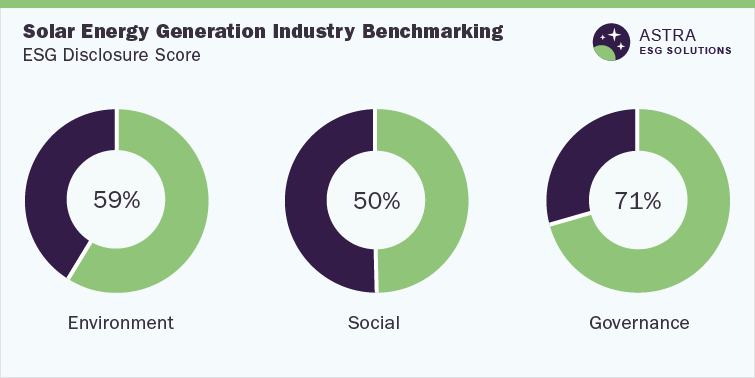

The average ESG score for the solar energy generation industry is between 55% and 65%. Our proprietary ESG scoring framework analyzed 65 parameters across the environment, social, and corporate governance, as represented in the methodology section of this document. E.ON SE, Exelon Corporation, and five other market leaders were part of our research. Four of the market leaders ranked above average industry scores. However, one company needs to focus more on ESG reporting and transparency, as it scored well below the industry average. The majority of sustainability-related disclosures are centered on governance metrics, followed by environmental and social disclosures.

E.ON SE leads the sector in terms of ESG disclosure, followed by Exelon Corporation and Equinor ASA.

For More Details: https://astra.grandviewresearch.com/solar-energy-generation-industry-esg-outlook

Environmental insights

Solar energy is one of the most impactful renewable energy sources that have significant potential in driving the energy transition. For example, solar panels can be used to generate clean power at home and reduce the cost of electricity in the long term. Solar panels are also a boon to the environment, as they reduce pollution. A well-built solar system within the premises can also help charge electric cars. Greater use of solar energy can, therefore, lower the need for nonrenewable fossil fuel sources, such as coal, natural gas, and so on. The use of solar power will have an immediate, measurable impact on the environment and provide a good Return on Investment (ROI).

The Exelon Corporation ranks first among the top five companies that have avoided around 78 million tons of GHG emissions through the use of zero-carbon nuclear power.

Overseeing the climate risk strategy is an imperative aspect that needs to be institutionalized. The climate strategy of Exelon Corporation is overseen by a Senior Vice President of Corporate Strategy and Chief Innovation and Sustainability Officer, while Equinor ASA's strategy is overseen by the Safety, Sustainability, and Ethics Committee (SSEC) of its board of directors. Furthermore, E.ON SE is one of the top three companies in the environmental sector, with 86% of sites certified according to ISO 14001.

Social insights

Solar energy generation companies have emphasized various social aspects such as turnover rate, health & safety, diversity, enterprise & employee/customer communications through surveys, and human rights alignment. These areas are essentially the foundation of a company’s social pillar. Our research found that ESG disclosure around social pillars has not been significant, and it has scope for improvement. With respect to social disclosure, E.ON SE leads the way, followed by Duke Energy Corporation and Exelon Corporation.

Among the top three companies, E. ON SE had the lowest turnover rate, which indicates the company has managed its human capital well with high employee satisfaction. All top three companies emphasized safety metrics, which is evident from the health and safety measures that are institutionalized within their operations. In addition to the safety measures, the majority of the companies within the sector also provide employees additional health benefits, including mental health support, programs that support emotional & social health, life coaching, and many other benefits. It was noticed that only one company had 87% of its business units certified to ISO 45001 while the other two did not have safety certifications.

Our assessment showed that all major companies within the sector have conducted comprehensive employee and customer satisfaction surveys.

Governance insights

According to our research, the average industry governance score is 71%, which is the highest among all the ESG pillars. The governance pillar included information on female board members, independent directors, compensation linked to ESG parameters, and clawback policy, among others. The industry leaders scored well above 75% in the corporate governance pillar, with Exelon Corporation scoring the highest, followed by E.ON SE and Duke Energy Corporation.

The corporate governance structure becomes robust with more independent representation on the board. Our research showed that 100% of E.ON SE's directors were Independent directors, while Exelon Corporation had the lowest percentage of independent directors. An inclusive board structure demonstrates the company's commitment to diversity as well.

Exelon Corporation had the highest percentage of females on its board at 33.33% followed by the others.

Country-level insights

The increased popularity of solar energy is quite evident from the rising number of solar energy producers across countries. The top solar power nations, such as China, are heavily reliant on clean energy with their 2030 net-zero target. The increase in clean energy investment has led to new economic and employment opportunities. Incentive policies for solar projects were introduced in the year 2020 across various countries. Few countries have also introduced incentive plans and have defined policies for solar power, which is explained in detail within the report.

Sembcorp Industries Ltd, a Singaporean company, acquired a 98% stake in GCN Capital Partners Infrastructure Fund III and its subsidiary for RMB 3.3 billion (USD 505,560,000).

Request for Free Demo: https://astra.grandviewresearch.com/solar-energy-generation-industry-esg-outlook/request/rs1

Oil Spill Management Market Analytical Overview, Size, Share, Growth Factors, Demand and Trends Forecast till 2025 [Energy]

July 21, 2021: The global oil spill management market is expected to cross a higher CAGR during the forecast period. Oil spill waste management results in generation and collection of huge quantities of oily waste. Gravel, emulsified oil, oiled sand, and accumulated debris could raise the waste volume to a greater extent of oil split originally. This waste typically surpasses the management of oily waste and response-relevant wastes can turn more time demanding and incur significant costs of an oil spill. Management of waste from a spill comprises setting up of logistical arrangement to allocate waste in a safe and efficient manner from the recovery point to disposal.

Market driving factors for oil spill management industry include rise in oil & gas transportation coupled with stringent policies of government pertaining to safety. Rise in huge investments for R&D positively is likely to impact the market development in the near future. In addition, strategic alliances for expansion could also result in market growth for the estimated period.

Request a Free Sample Copy of this Report @ https://www.millioninsights.com/industry-reports/oil-spill-management-market/request-sample

Technological segment for oil spill management market includes pre-oil spill and post-oil spill. Pre-oil spill and post-oil spill are further segmented into offshore and onshore. By response technique, the oil spill management industry includes chemical recovery, biological recovery and mechanical containment & recovery.

Geographical segment for oil spill management market includes North America, South America, Europe, Asia-Pacific, Middle East and Africa. North American market is expected to dominate the market in the forecast period owing to stringent policies and regulatory framework by government. Asia-Pacific’s market is anticipated to rise at a significant CAGR owing to increased oil and gas exploration activities and government support for tax benefits and financial assistance for R&D activities.

The key players in the oil spill management market include Skim Oil Inc, OMI Environmental Solutions, American Green Ventures Inc, Spill Response Services, Oil Spill Response Limited, Osprey Spill Control and Fender.

Browse Full Research Report @ https://www.millioninsights.com/industry-reports/oil-spill-management-market

Market Segment:

Technology Outlook (Revenue, USD Million, 2014 - 2025)

• Pre-oil spill

• Double-hull

• Pipeline leak detection

• Blow-out preventers

• Others

• Post-oil spill

• Mechanical

• Chemical

• Biological

• Others

Post-Oil Spill Management Response Technique Outlook (Revenue, USD Million, 2014 - 2025)

• Mechanical containment and recovery

• Containment booms

• Hard booms

• Sorbent booms

• Fire booms

• Others

• Skimmers

• Weir skimmers

• Oleophilic skimmers

• Non-oleophilic skimmers

• Others

• Sorbent

• Others

• Chemical recovery

• Dispersing agents

• Gelling agents

• Others

• Biological recovery

• Others

Application Outlook (Revenue, USD Million, 2014 - 2025)

• Pre-oil spill

• Onshore

• Offshore

• Post-oil spill

• Onshore

• Offshore

Regional Outlook (Revenue, USD Million, 2014 - 2025)

• North America

• U.S.

• Canada

• Mexico

• Europe

• UK

• Russia

• Asia Pacific

• China

• Japan

• Central & South America

• Middle East & Africa

Get in touch

At Million Insights, we work with the aim to reach the highest levels of customer satisfaction. Our representatives strive to understand diverse client requirements and cater to the same with the most innovative and functional solutions.

Contact Person:

Ryan Manuel

Research Support Specialist, USA

Email: ryan@millioninsights.com