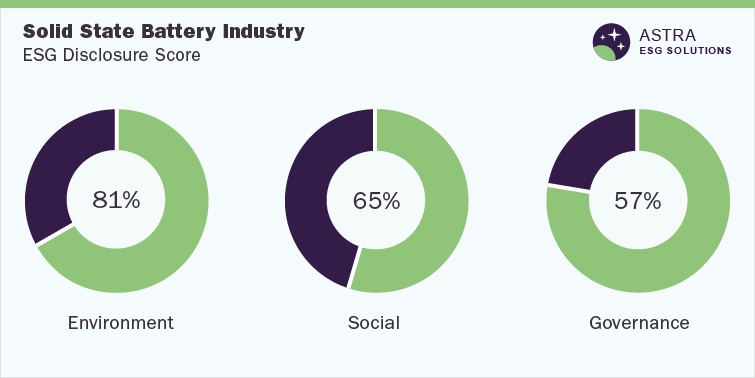

Automakers seek Solid State Battery to Bolster ESG Performance [Business]

Auto-makers have exhibited increased traction to cut battery’s carbon footprint, encouraging solid-state battery industry players to propel environmental, social and governance (ESG) goals. Solid state batteries (SSBs) store more energy, provide greater safety and charge faster compared to liquid lithium-ion batteries. Since a few batteries are required, SSBs can boost energy density per unit, making the technology highly sought-after in the EV landscape. SSBs could propel the ESG performance with several watchdogs vouching for the batteries. According to Transport & Environment (T&E), solid state batteries can minimize the carbon footprint of EV batteries by two-fifths. With solid state batteries poised to be used in EVs by 2025, battery manufacturers have furthered their investments in the ESG ecosystem.

The sustainability of battery supply chains has become pronounced as companies seek to reap upsides from using SSBs. These batteries promise to attain the Paris Agreement, boost energy access and economic value and foster decarbonization. Companies could shift to a circular value chain to enhance their economic and environmental footprint and by harvesting end-of-life values from batteries. With investors looking for companies with better ESG scores, stakeholders could focus on deploying SSBs in electric vehicles. Stakeholders are bullish towards safe working conditions and have exhibited respect for human rights by keeping the child and forced labor at bay. Private companies and public stakeholders are expected to expedite the share of renewable energies in the value chain.

Environmental Perspective

The growth of SSBs is likely to foster green energy and e-mobility as stakeholders strive to minimize their carbon footprint. The European climate group has pitched for incentives for the production of batteries with a lower carbon footprint in the new EV battery regulations—EU governments and MEPs are negotiating the final text of the regulation. In December 2020, the European Commission reportedly tabled a proposal for the modernization of the regulatory framework for batteries and bolstering the sustainability of EU battery value chains.

Although SSBs are at a low technology readiness level, strong demand from EV manufacturers to offset initial costs and propel sustainability could augur growth. The need for intensive actions against climate change and to bring the automotive sector to greenhouse gas neutrality has become an enabler for technological advances and buoyant policies. For instance, Toyota Motor Corporation issued Challenge 2050 to underpin the creation of a more sustainable and inclusive society. The company aims to reduce CO2 emissions from new vehicles by 30% by 2025 and 90% by 2050.

Solvay has a bullish plan to achieve carbon neutrality—scope 1 and 2—before 2040 for all businesses barring soda ash. The audacious goal is underpinned by an investment program of approximately €2 billion (USD 2.05 billion). The next-generation power source for EVs will continue to be sought to underscore the environmental profile. In July 2022, Nikkei, in partnership with Patent Result, inferred that Toyota had a massive lead in the solid-state battery patents—with 1,331 known patents.

Social Perspective

Industry partners have prioritized social contributions activities to enrich society and communities. In February 2022, Samsung SDI established a sustainable business management committee to propel ESG efforts. The company is gearing up for a full transition to renewable energy by 2050. The battery firm stood first with around 70% score, partly due to bullish efforts to propel work environment, diversity and human rights. In April 2022, Samsung SDI set out Safety Environment Management Policy to create safe and healthy corporate values, implement environmentally friendly management and form an external green community. In 2021, the company appointed around 299 CAs to take the organizational culture to the next level through team member development, fair appraisal, better collaboration, enhanced work efficiency and open communication.

Amidst occupational accidents becoming pervasive and denting the economy and employees’ health, stakeholders have responded with buoyant policies. In May 2021, the firm operated the “Eradicating Serious Accidents Task Force” to bolster safety and keep occupational injuries at bay. The South Korea-based company has expedited labor-management communication to enhance the work environment and protect labor rights. In 2020, around 1,193 issues were reportedly submitted and addressed with robust follow-up measures.

The diversity of directors has come to the fore as a driver of social portfolio for efficient decision-making and supervision. In 2020, Samsung SDI appointed four independent directors on the basis of expertise in areas, including law/human rights, electrical and electronics industry, accounting/tax and labor policy/relations. The company has placed no limitations on the basis of religion, gender, race, nationality, ethnicity or cultural background.

Companies have also prioritized the ESG committee to underpin sustainability. In 2021, Solvay rolled out its first employee share purchase program to propel the feeling of ownership among employees. Moreover, 98 of its 105 sites have observed a security vulnerability self-assessment (SVSA). It has also rolled out “Solvay One Dignity” to eradicate discrimination, providing equal opportunities for every employee. The company also announced the introduction of its first employee stock ownership plan. Moreover, in 2021, Solvay introduced a ten-year “STAR Factory Program” to cash in on digital and data science and make all plants STAR factory certified by 2030.

Is your business one of participants to the Global Solid State Battery Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Well-established and emerging players have reinforced governance, ethics and transparency to create a sustainable value for all stakeholders. Companies have raised the bar in ESG performance to pursue their sustainability vision. The repercussion of unsound governance could expand beyond the realm of financial results, prompting financial bodies to mandate governance disclosure reports. With environmental and climate issues placed at the top of agendas, governance practices and disclosures could underscore a culture of sustainable value creation.

The ESG scoring model of Grand View Research has ranked Solvay second to none—with a 70% score—in corporate governance. The top rank is mainly due to its efforts to foster governance practices with an emphasis on independent directors. In 2021, the company had 64% independent directors and the stand-alone ESG committee made a new carbon neutrality ambition recommendation to the board. The board backed the introduction of an employee share purchase plan providing Solvay personnel the chance to buy company shares at a 10% discount.

Prominent companies have underscored the focus on sound governance, the ratio of independent directors, compliance training and taking disciplinary actions for corruption. Around 12,598 Samsung SDI employees completed ethics and compliance training, while there were 26 compliance review activities in 2021. The company appoints a chair of the BOD among directors to boost the flexibility of BOD operations and enhance directors’ accountability. The South Korean firm rolled out the Samsung Compliance Committee in February 2020 to propel compliance oversight and control at the company’s seven primary affiliates. In 2021, it amended all guidelines managed by the compliance team and provided training and reviews to alert employees about the risk of regulatory non-compliance.

Forward-looking companies are assessing risks, opportunities and issues pertaining to sustainability amidst the expanding footprint of solid state batteries. With longer ranges and quicker charging times, SSBs could be the game changer for the electric vehicle manufacturers and other stakeholders. In January 2022, Toyota announced its first vehicle to use SSBs would be hybrid and would go on sale by 2025. Meanwhile, in June 2022, Solid Power announced it would be shipping solid state battery cells to BMW and Ford by the year-end for validation testing. Prevailing trends allude to a robust growth outlook in the ensuing period. The global solid state battery market is expected to witness around 36% CAGR from 2021 through 2028. Policies and approaches toward ESG could dictate the growth trajectory as automakers seek massive EV battery breakthroughs.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

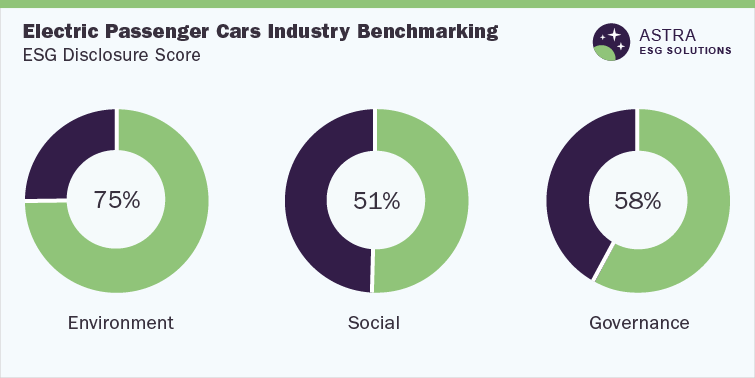

Significance of ESG to Stay Ahead of the Game in Electric Passenger Cars Industry [Business]

A notable surge in the adoption of electric mobility, underpinned by developments in autonomous and driver-assistance systems (ADAS), mobility sharing and digitization has fostered the electric passenger cars industry size. The need for decarbonization and uptake in climate-specific funds have boded well for stakeholders promoting ESG goals. With motor vehicles being one of the principal contributors to GHG emissions, automakers are likely to prioritize environmental, social and governance pillars. Moreover, soaring demand for personal vehicles across emerging economies and the need for product safety will remain invaluable to bolster the sustainability quotient.

Stakeholders, such as governments, consumers and investors, are encouraging OEMs to become carbon-free and propel ESG metrics. For instance, investors expect companies to emphasize ESG aspects, with consumers exhibiting traction toward the brand that values ethical and sustainable value chain. Industry leaders are likely to prioritize ESG to simplify compliance, enhance customer trust, foster investor confidence and propel brand reputation. Companies are likely to adopt United Nations Sustainable Development Goals, greenhouse gas protocol, International Labor Organization (ILO), Sustainability Accounting Standards Board (SASB), United Nations Global Compact (UNGC) and International Organization for Standardization (ISO).

Bullish demand for minerals, including aluminum, copper, lithium, cobalt and nickel poses major concerns. High emissions and waste and water pollution from mineral extraction and processing could subside the social and environmental upsides of EVs. Stakeholders are slated to focus on fostering eco-friendly manufacturing and propelling sustainability. For instance, SQM, one of the largest producers of lithium in the world, contemplates boosting capacity two-fold by 2025. It is geared to minimize water usage by 50% and become carbon neutral by 2030.

Environmental Perspective

Government regulations have put pressure on automakers to enhance fuel efficiency amidst emissions stemming from vehicle usage instead of the process of manufacturing vehicles. Climate change regulations have compelled auto companies to bolster fuel efficiency. To illustrate, Toyota aims 30% reduction of global average CO2 emissions by 2025. The company also rolled out Green Purchasing Guidelines to emphasize purchasing low-environmental-footprint parts and equipment. As minimizing carbon emissions has become business-imperative, companies are expected to report Scope 1, 2—mandatory to report— Scope 3—voluntary—to gain a sustainable competitive edge. General Motor Company aims 72% reduction of Scope 1 and 2 emissions by 2035. Besides, MMC uses Total Quality Management tools, such as Plan-Do-Check-Act (PDCA), to monitor the progress of its goals.

Regulators, Investors and stakeholders have exhibited an increased inclination for stringent emission standards as an emphasis on the environmental consequences of their business activities could augur well for society. In September 2022, General Motors Co announced its support for forming rigorous federal emissions standards to help ensure that at least 50% of new vehicles sold would be zero-emission by 2030. The company has an audacious goal of doing away with tailpipe emissions from new light-duty vehicles by 2035. In a bid to expedite its shift to an all-electric future, GM plans to manufacture over one million units of EV capacity in North America and China by 2025.

Social Perspective

An uptick in the number of car accidents has posed challenges to automakers to propel product safety for brand value and reputation. Toyota Motor Corporation is at the top with a social disclosure score of 67%. The company has adopted Zero Casualties from Traffic Accidents goal and is offering support to drivers to eliminate traffic fatalities. The automotive giant has ramped up investments in autonomous vehicles with an infusion of USD 500 million in autonomous ridesharing and Uber. Amidst a surge in demand for passenger vehicles, Toyota has introduced programs that can augment the useful life of its models and reuse/recycle end-of-life vehicles.

Auto companies are poised to prioritize a decent work environment and economic growth as a vast supply chain exposes companies to the risk of human rights violations. For instance, in April 2022, General Motors asked suppliers to ink a new ESG Partnership Pledge to commit to human rights, climate and sustainable procurement. The automotive behemoth vies for a certain score by 2025 for issues including diversity and non-discrimination, employee health and safety, and child and forced labor, among others. Meanwhile, MMC witnessed the highest employee turnover—around 3.33%—in the fiscal year 2020. Companies are likely to focus on measures to prevent modern slavery and protect the human rights of foreign workers. Toyota annually issues a statement on “Toyota’s action taken for Forced Labor of Migrant Workers (Statement on the Modern Slavery Acts)” within its report to foster awareness of forced labor at production sites in Japan and across the world.

Is your business one of participants of the Global Electric Passenger Cars Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Industry partners and other stakeholders prioritize transparency and sustainability reports to analyze and propel, including but not limited to gender diversity, directors’ roles and equity. Stakeholders have reinforced the significance of independent directors in enhancing governance and sustainability portfolios. Needless to say, independent directors act as a watchdog to oversee the operation and functioning of the senior management from a neutral perspective. Notably, GM has 12 independent directors out of 13. Moreover, 54% of its directors are women, with 67% of board committees chaired by women. The company asserted the Audit Committee would review and oversee the Sustainability Report from 2022.

Ford Motor Company and GM have a governance score of more than 70%. The former has a bullish cybersecurity program, while the latter and MMC have a cybersecurity committee. Ford has been complying with global cybersecurity standards for automakers and has adopted the Automotive Consumer Protection Principles. VW has augmented its ESG portfolio following the diesel-engine scandal wherein pervasive cheating was done on emissions tests. Volkswagen Group has underscored its efforts on transparency in the procurement of battery raw materials. For instance, in September 2020, VW joined forces with RCS Global to emphasize auditing suppliers for conformance with safe working conditions, human rights and environmental protection.

The competitive landscape alludes to the infusion of funds into organic and inorganic strategies to foster their sustainability profiles. To illustrate, in April 2022, Mercedes-Benz announced it would cut CO2 emissions by half per passenger car over the lifecycle by the decade-end. It aims for around 50% share of BEVs and plug-in hybrids by 2025. With EVs being an essential part of sustainable transportation, stakeholders expect robust growth. The electric passenger cars market size garnered USD 120.81 billion in 2020 and is expected to depict a 32.5% CAGR from 2021 to 2028. The future of passenger vehicles could be electric and prompt stakeholders to underpin their ESG goals.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. - a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

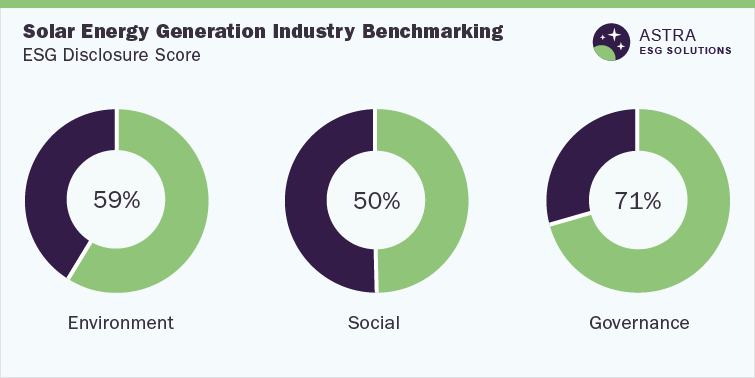

Solar Energy Generation Industry: Leaders Create a Sustainable Future—an ESG Perspective [Energy]

The Growth of the solar energy generation industry will depend on the proactive and relentless efforts of forward-looking companies to navigate the risks posed by climate change. Current and predicted issues expected to arise due to climate change have brought a paradigm shift in the ways businesses assess risk, and plan and deploy resources. Sustainability, security compliance, safety, business growth, and innovation have become instrumental to progress toward implementing best practices in environmental, social, and governance portfolios. The trend for green, sustainable, and safe pathways is likely to pay off and help make better economic sense in the long run. Prominently, solar energy generation has garnered popularity as one of the cheapest forms of electricity and will be a solid proposition to tap potential in energy generation.

In common parlance, solar energy plays an invaluable role in boosting sustainable development energy solutions. Solar energy generation applications are likely to play a vital role in fostering an environmentally friendly energy agenda. In essence, solar panels have gained ground to generate clean power and contain the cost of electricity. To illustrate, in June 2022, the U.S. Solar Buyer Consortium announced an infusion of USD 6 billion to bolster the domestic solar panel ecosystem with the supply of around 7 GW of solar modules per year from 2024. It is worth mentioning that the Solar Energy Industries Association asserts that the U.S. installed 23.6 gigawatts of solar capacity in 2021. The federal investment tax credit, along with renewable energy credits, advanced technologies, reduced installation costs, and financing arrangements, offers promising opportunities for stakeholders to emphasize solar power as an indispensable part of the ESG goals across the U.S.

Exelon Corporation Harnesses the Potential of ESG

With environmental issues spurring governance and social practices, investors are curious to know how businesses minimize their carbon footprint. Stakeholders are responding to these trends through ESG strategies. Several companies have come to the fore to inject funds into renewable energy to propel ESG sustainability goals. For instance, the Exelon Corporation reportedly avoided 78 million metric tons of GHG emissions with its zero-carbon nuclear generation. The company witnessed 161 million MWh zero-carbon generation, around two-fold more compared to the next largest producer. In July 2022, Exelon released the 2021 Corporate Sustainability Report and noted that it poured USD 6.6 billion in energy infrastructure in 2021 and is contemplating raking in USD 29 billion from 2022 through 2025. On the environmental front, the company claims to be working to minimize impacts on biodiversity and watersheds. It has also spurred sustainability through corporate governance—assessing accountability and risk.

Understand how key industry participants like Exelon Corp., E.On S.E., and Duke Energy Corp. are understanding and mitigating ESG risks and ensuring compliance

E.ON SE at Pole Position in ESG Disclosure; Emphasizes Green Electricity

Sustainability strategies and disclosures have come on the horizon amidst ESG being tasked with the goal of decarbonizing the global economy. When it comes to ESG disclosure, E.ON SE is at the helm, followed by Exelon Corporation and Equinor ASA. It is gearing to be climate-neutral by 2040 and its corporate governance is increasingly linked to its ESG management aspects. CDP, an international association of investors that independently assesses the transparency and detail of companies’ climate reporting, lauded E.ON as a Supplier Engagement Leader in 2021. In a bid to bolster the green-power community across Europe, E.ON Home, an energy management app, was introduced in the U.K. Similarly, it claims over 10 million customers received certified green electricity products in 2021.

Incumbent players have reinforced their efforts to underpin the decarbonisation of Europe. The company contemplates investing €1 billion (around USD 1 billion) annually through 2026 to significantly boost the infusion of funds into energy networks. It is geared to foster sustainable homes, work, and lifestyles with innovative solutions, including self-generated green electricity. It aims to install approximately 5,000 new charging points through 2026. The Germany-based company plans to pour €27 billion into energy transition through 2026. Furthermore, the company has also upped investments to provide green energy to take carbon neutrality and sustainability to the next level. For instance, in April 2022, E.ON inked a deal with Solar Market to create Green Cloud to offer green energy to corporate customers across Hungary.

The competitive landscape alludes to an increased focus on ESG framework and sustainable policies from forward-looking companies, such as E.ON SE, Adani Green Energy Limited, Equinor ASA, Nextera Energy, Inc., Exelon Corporation, Duke Energy Corporation, Solaria Energía y Medio Ambiente and ReNew Wind Energy (Jath) Limited. Besides, organic and inorganic growth strategies have become pronounced, underscoring solar energy generation market share. To illustrate, in November 2022, Equinor announced the acquisition of BeGreen, a Danish solar developer, to propel the solar PV portfolio. Meanwhile, in April 2022, the Norway energy giant forayed into the Australian market through investments in RayGen to provide impetus to solar energy. In November 2022, Equinor expressed contemplation to augment investment in renewables by two-fold and that renewable energy will account for approximately 20% of the company’s investments in 2022. Amidst the trilemma of the Russia-Ukraine war, energy security, and affordability, emphasis on renewable energy sources could be a game-changer with considerable environmental upsides in solar energy generation.

Is your business one of participants to the Global Solar Energy Generation Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices

About Astra – ESG Solutions by Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research

Cloud Computing Industry Drives Business Agility with ESG [Business]

Environmental, social and governance (ESG) performance has become invaluable in minimizing carbon footprint, boosting waste management and enhancing board diversity in the cloud computing industry. The rising footprint of cloud services across healthcare, automotive, media, gaming, financial services, public services and e-commerce has furthered the need to bolster the sustainability profile. Brands are expected to use AR/VR, edge computing, big data, blockchain and cloud-native technologies to foster brand recognition, complement sound corporate behavior and bolster sustainable investing.

ESG strategies have gained prominence in the wake of surging environmental awareness and consumers’ willingness to pay premium prices for sustainable products. Environmentally and socially conscious practices have become prevalent to attract and retain investors and customers. Cloud computing service providers have exhibited profound traction to expedite their ESG progress. For instance, the Google Cloud Platform offers carbon-free energy scores for Google Cloud regions, enabling companies to choose GCP locations optimized for reduced carbon emissions.

Key Companies in this theme

• Adobe Inc.

• Alibaba Group Holding Limited

• Amazon Inc.

• Google LLC

• International Business Machines Corporation

• Microsoft Corporation

• Toshiba Corporation

Environmental Perspective

The global push to meet sustainability goals has prompted forward-looking organizations to achieve their ESG objectives. Industry leaders are inclined to use green equipment in data centers to minimize power consumption. Moreover, businesses are expected to receive impetus from recycling and reuse to reduce waste and capital expenditure. In essence, Google suggests that 5 of its data centers operate at almost 90% carbon-free energy (CFE). With data centers continuing to be sought-after in the energy transition, sustainable cloud services will witness investments galore. In August 2021, the American giant announced an infusion of USD 1.2 billion in Germany’s Cloud Computing Program by 2030 to undergird cloud computing infrastructure and renewable energy usage.

Social Perspective

Diversity representation and the emphasis on inclusivity have become a viable portfolio to foster a positive change within the company and across societies. Prominently, women account for over 30% of the Microsoft workforce globally. Moreover, women in technical roles have risen between 1.4 and 1.6% points over the past half a decade. It has also embarked on a mission to represent the population of people with disabilities. As of June 2022, around 7.8% of the Microsoft employees in the core business in the U.S. self-identified as having a disability. With the global push to propel racial equity, the company has injected around USD 150 million to reinforce inclusion and the number of U.S. Black and African American and Hispanic and Latinx people managers, senior leaders and senior individual contributors by 2025. An emphasis on diversity, equity and inclusion will redefine computing solutions and help employees be more innovative and creative.

Is your business one of participants to the Global Cloud Computing Industry? Contact us for focused consultation around ESG Investing, and help you build sustainable business practices.

Governance Perspective

Cloud-based management can unlock avenues of growth in ESG with increased transparency, data standardization, and process automation. Tax transparency, board diversity, executive pay, and sound governance structure will leverage companies to create long-term value. Brands and institutions have fostered governance frameworks and brought new skills and global perspectives. To put this in perspective, eleven out of 12 director nominees are independent in IBM. Meanwhile, two women directors and three ethnically diverse directors were included in the past three years, according to the IBM 2021 ESG report. The American giant has an Audit committee to help identify financial and audit risks with the assistance of IBM’s enterprise management framework about AI ethics, privacy and cyber. Development of practices and policies that emphasize transparency, trust, ethics and accountability could be pronounced, auguring well for the industry growth.

The competitive landscape indicates an increased focus on organic and inorganic strategies, such as technological advancements, product offerings, mergers & acquisitions, innovations and collaborations. For instance, in October 2022, Alibaba announced opening a new campus with investments in cloud computing. The design of the campus is reportedly eco-friendly, including flowerpots made from recycled plastic, a photovoltaic power generation system and high-efficiency low-energy devices in the on-site coffee shop. The global cloud computing market size was pegged at USD 368.97 billion in 2021 and could observe a 15.7% CAGR between 2022 and 2030.

About Astra – ESG Solutions By Grand View Research

Astra is the Environmental, Social, and Governance (ESG) arm of Grand View Research Inc. – a global market research publishing & management consulting firm.

Astra offers comprehensive ESG thematic assessment & scores across diverse impact & socially responsible investment topics, including both public and private companies along with intuitive dashboards. Our ESG solutions are powered by robust fundamental & alternative information. Astra specializes in consulting services that equip corporates and the investment community with the in-depth ESG research and actionable insight they need to support their bottom lines and their values. We have supported our clients across diverse ESG consulting projects & advisory services, including climate strategies & assessment, ESG benchmarking, stakeholder engagement programs, active ownership, developing ESG investment strategies, ESG data services, build corporate sustainability reports. Astra team includes a pool of industry experts and ESG enthusiasts who possess extensive end-end ESG research and consulting experience at a global level.

For more ESG Thematic reports, please visit Astra ESG Solutions, powered by Grand View Research